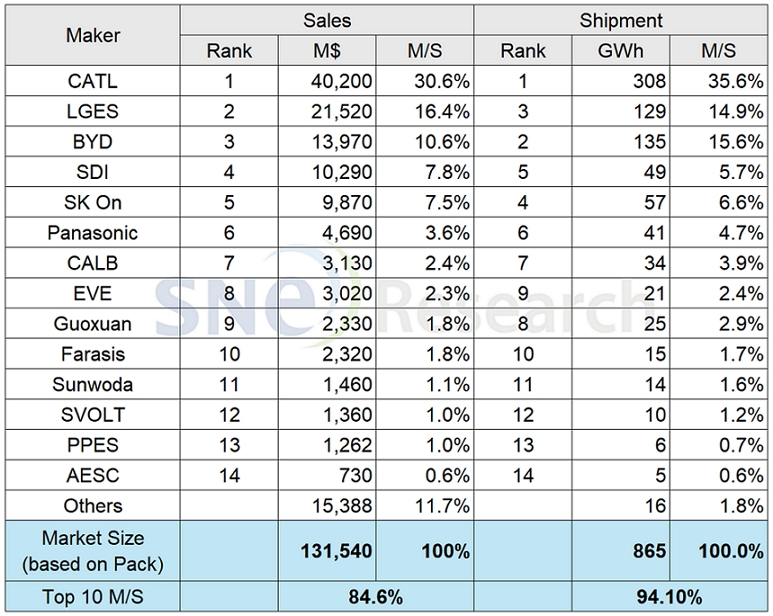

2023 Global EV Battery Sales Volume by Battery Maker

The global EV battery sales by battery maker in 2023 was 865GWh, worth of 132B$ in terms of market size (based on pack).

If we look at the market share by the K-trio battery makers based on their sales, LGES ranked 2nd with 16.4%, SDI ranked 4th with 7.8%, and SK On took the 5th place with 7.5%, resulting in all of them entering the top 5. CATL stayed at the top of list with 30.6% of M/S, and BYD, showing a high growth, ranked 3rd with 10.6% of M/S.

In terms of battery shipment, CATL took No. 1 position (35.6%) followed by BYD (15.6%). If we look at the ranks of K-trio makers, LGES captured 3rd place with 14.9%, SK On ranked 4th with 6.6%, and Samsung SDI took the 5th place with 5.7%.

Panasonic took the 6th position on both rankings of sales and shipment as its J/V partner, PPES, took over prismatic battery business and Panasonic has been focusing on selling its cylindrical battery cell to Tesla.

Although the in-between gaps from the 7th to 11th positions have not been noticeably wide, those positions on the ranking seemed to be gradually settled among the Chinese battery makers. CALB, propped up with a recent high growth, took the 7th place, followed by EVE and Guoxuan. Farasis and Sunwoda have been competing for the 10th place on the list.

*) SNE Research Estimate, 2024

Taking a closer look at the sales and shipment of battery makers, those in top 10 have their reputations expanded in the market. In terms of shipment, the shares taken by top 10 battery manufacturers are 94%, and those by top 5 reach 78.4%, meaning that the market dominance by the 1st tier battery makers is very high and the current landscape in the battery market seems to be hard to change for a while.

With high interest rates continued in the market, the global electrification has slowed down as the initial demand for electric vehicles terminated and car OEMs turned to profit-driven business management strategies. Such slowdown is expected to linger on till 2025. In this regard, battery manufacturers decided to take various response measures such as establishing a close cooperation with car OEMs. Car OEMs also have been devoting all their energy in preparation for future expansion of electric vehicle market by ramping up their own battery production lines for in-house battery manufacturing. Amidst major EV markets all entering a phase of gentle growth in 2024, it is expected that, within 2 or 3 years, taking a dominant position with price competitiveness based on a stable supply chain in Europe and North America would become a great advantage for battery makers in future.